maine excise tax form

Excise tax on wine. When offering samples at a taste-testing festival.

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Individual Vehicle Mileage and Fuel Report.

. By signing this tax excise tax report the licenseeunderstands that false statements made on this are punishable by form. You can download a PDF of. Active Duty Stationed In Maine Excise Tax Exemption MV-7 Antique Auto Antique Motorcycle Horseless Carriage Custom Vehicle and Street Rod Affidavit MV-65 Authorization for.

The motor vehicle excise tax is a local tax. Excise tax receipt and photocopy of the reimbursement payment. Contact the BMV Registration Section at.

72 Consecutive Hour Trip Permit Application. DYER LIBRARY SACO MUSEUM. 2021 -- 1750 per 1000 of value.

When importing malt liquor into Maine. To find the MSRP of an existing registration. Calculation will be based on.

Total Excise Tax Due multiply line 7 by 035 thirty-five cents 8. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below.

How to use sales tax exemption certificates in Maine. Gallons received from any source on which Maine excise tax has been. 18 rows The purpose of the tax is to partially offset the costs of forest fire protection.

The excise tax calculation is based on. Real Estate Withholding REW Worksheets for Tax Credits. When the registrant underpaid excise tax call the town and do the same procedures as above in reverse.

2019 -- 1000 per 1000 of value. To apply for the exemption the resident must provide documentation by filling out The Active Duty Stationed in Maine Excise Tax Exemption Form. 2 Low-alcohol spirits products excise tax 124gallon spirits products to.

Ad GTR-PS Fuel Tax More Fillable Forms Register and Subscribe Now. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Maine sales tax. What is excise tax.

Manufacturers suggested retail price MSRP How is the excise tax calculated. The Form can be found at Bureau of. For electronic filing of the form according to the Instructions for Form 8849 you can find information on e-file and its availability by visiting the IRS Electronic Filing Options for.

The last step will be to subtract the excise tax based on the sale price from the excise tax based on the. Funds raised through the collection of the excise tax remain in your community. YEAR 1 0240 mill rate.

2018 -- 650 per 1000. To find the MSRP if you do not have an existing registration on hand. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning.

MAINE OFFICE OF TOURISM. YEAR 3 0135 mill. 2020 -- 1350 per 1000 of value.

Specific Instructions for the Marijuana Excise Tax. Home of Record legal address claimed for tax purposes. Watercraft Excise Tax Payment Form.

Electronic Request Form to request individual income tax forms. Please record your registration number on your check. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax.

Return to MAINE REVENUE SERVICES PO BOX 1065 AUGUSTA ME 04332-1065. YEAR 2 0175 mill rate. IFTA Fuel Tax Form 3rd quarter 2020.

Individual Income Tax 1040ME Corporate Income Tax 1120ME Estate Tax 706ME Franchise Tax 1120B-ME Fiduciary Income Tax 1041ME Insurance Tax. The amount of tax is determined by two things. The MSRP is listed on your current registration form under Base.

This individual is permanently assigned to the unit and station identified above is on active duty and. Except as provided in subsection 2-A the in-state manufacturer or. Boat Launch Season Pass -.

The age of the vehicle. IFTA Fuel Tax Form 4th quarter 2020. An excise tax is imposed on the privilege of manufacturing and selling wine in the State.

Blank forms schedules instructions fuel tax rates a list of licensed special fuel suppliers and other tax information. Below you will find the Town of Eliot Boat Excise Tax Payment Form for downloadcompletion along with the Maine Watercraft Excise Tax Table for computing the boat excise tax due. 2022 Watercraft Excise Tax Payment Form.

2022 -- 2400 per 1000 of value. The excise tax due will be 61080 A registration fee of 3500 and an agent fee of 600 for new vehicles will also be charged for a total of 64180 due to register your new vehicle. 2022 Watercraft Excise Tax Payment Form.

How much is the excise tax. Maine generally imposes an income tax on all individuals that have Maine-source income. The next step will be to calculate the MSRP amount MSRP x mill rate.

The rates drop back on January 1st of each year.

Federal Excise Tax Setup In Quickbooks Online

Excise Tax Information Cumberland Me

Massachusetts Enacts Elective Excise Tax For Pass Through Entities Albin Randall And Bennett

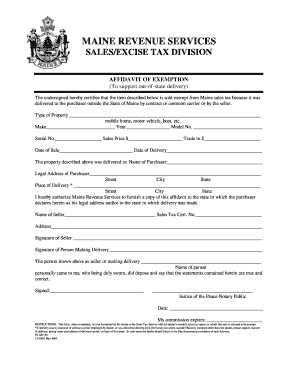

Fillable Online Maine Maine Revenue Services Salesexcise Tax Division Affidavit Of Exemption Form Fax Email Print Pdffiller

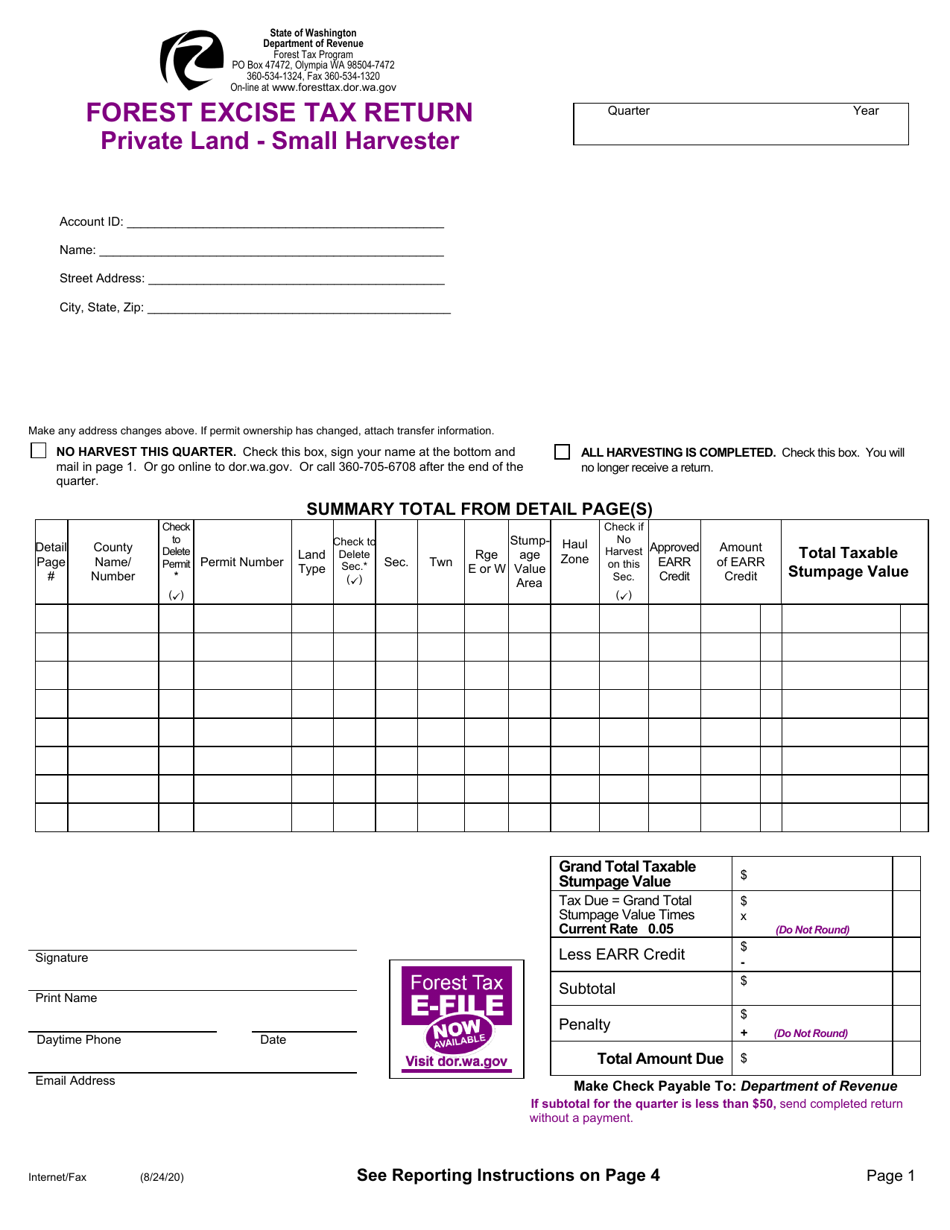

Washington Small Harvester Forest Excise Tax Return Download Printable Pdf Templateroller

Pin By Rahul Prem Shakya On Safe Shop Online Marketing Pvt Ltd Online Marketing Business Signage Marketing

Ultimate Excise Tax Guide Definition Examples State Vs Federal

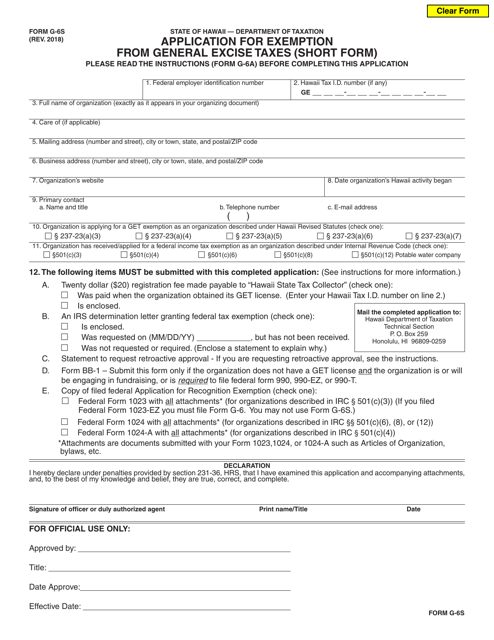

Form G 6s Download Fillable Pdf Or Fill Online Application For Exemption From General Excise Taxes Short Form Hawaii Templateroller

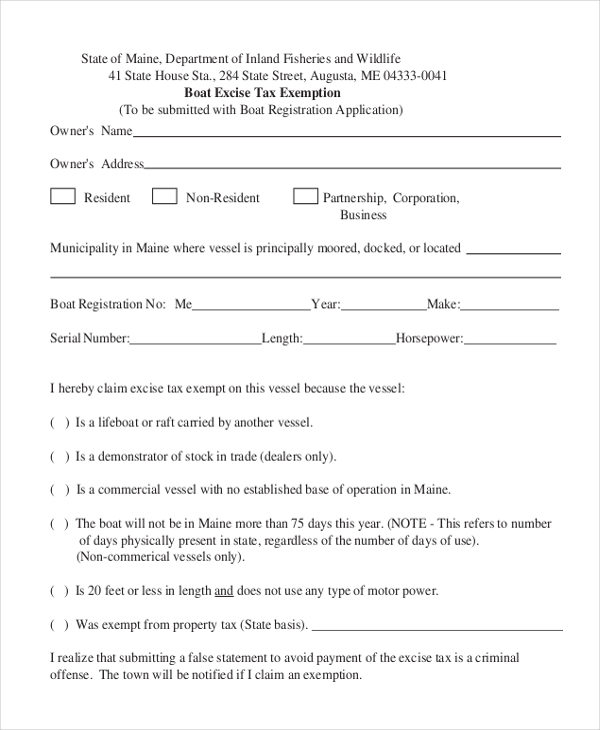

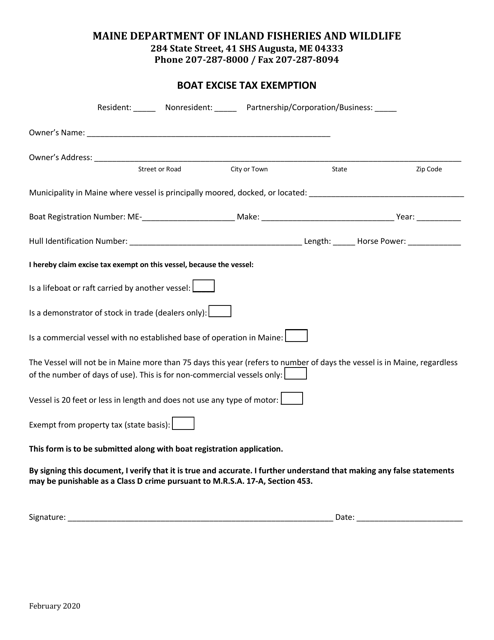

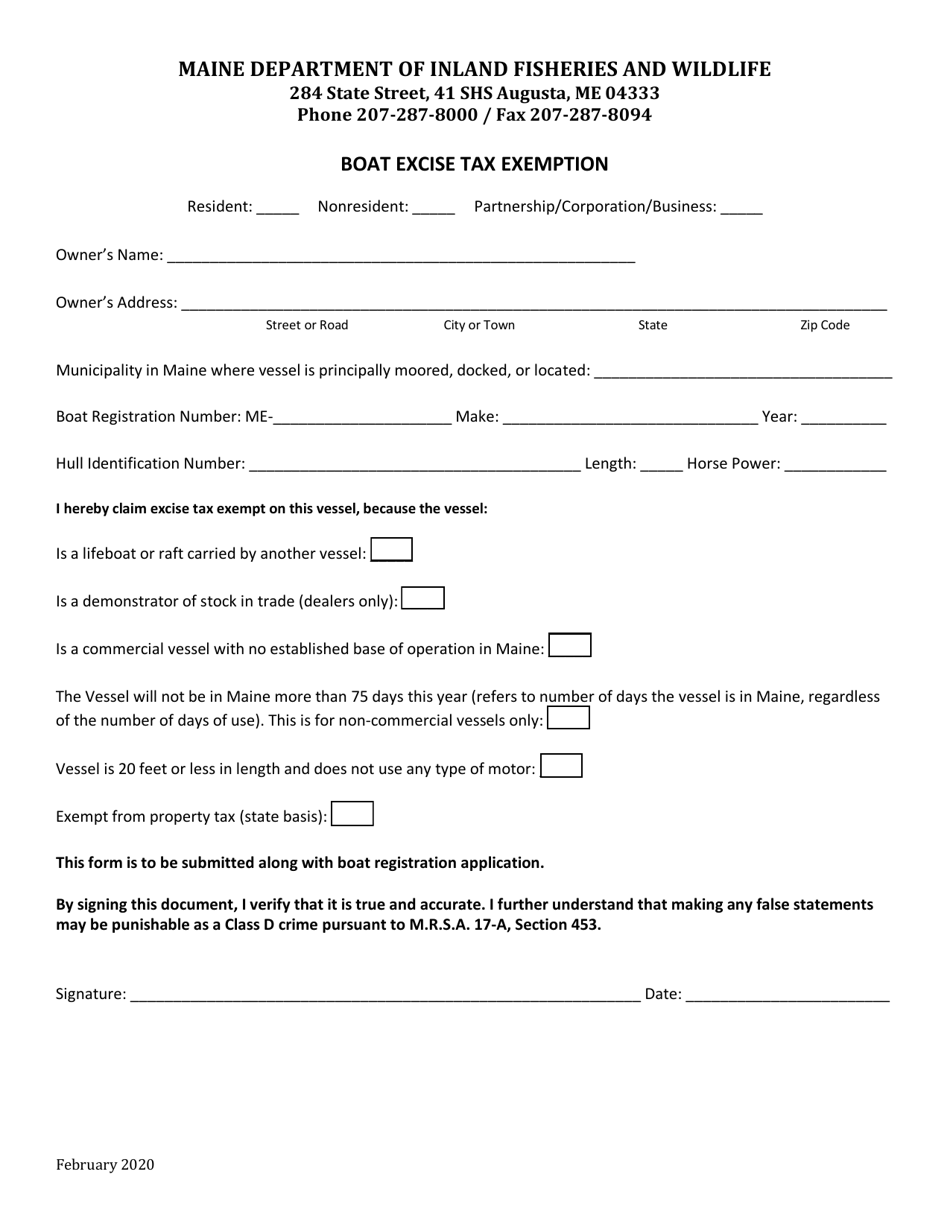

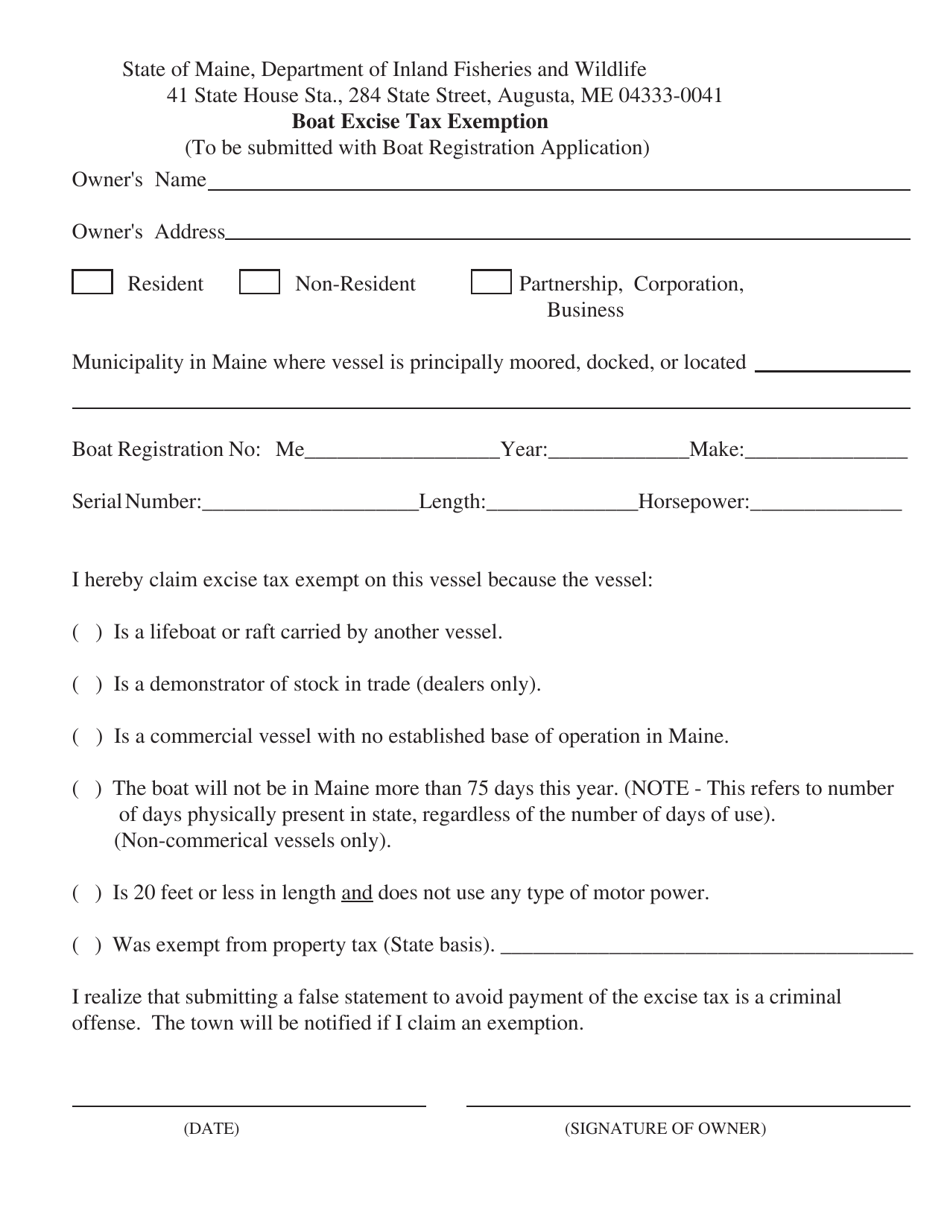

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

How Is Tax Liability Calculated Common Tax Questions Answered

Pinal Road Excise Tax On Ballot In November Area News Pinalcentral Com

Maine Boat Excise Tax Exemption Download Fillable Pdf Templateroller

Free Wyoming Limited Power Of Attorney Form For Excise Tax Adobe Pdf Word

New Analysis A Third Of Nc Taxpayers Won T Benefit From Proposed Tax Refund Plan Itep

Maine Boat Excise Tax Exemption Download Printable Pdf Templateroller